I have yet to share my personal #Bitcoin journey, but I believe now is the right time to do so. It marks the beginning of my descent into the Bitcoin rabbit hole and, much like the Bitcoin White Paper itself, my story is closely tied to the financial crisis of 2008.

This account is deeply personal, laced with self-pity and a sense of stupidity. That's why I've kept it private and not even shared it with my closest friends, but I think it's important to share it now with you. Giving back to a community I received so much in the previous years. All too often, those who fall victim to the shortcomings of the fiat system internalize the guilt, unaware that they are being taken advantage of by a corrupt fiat system.

My parents, hardworking individuals who dedicated their lives to building their own business from scratch, had little time to acquire financial education. In the early 2000s, they were advised — like many companies and individuals in Austria — to finance their company/house with a Swiss franc loan. The arrangement was complex and opaque, involving multiple loan accounts and significant commissions for both the bank and our financial advisor. My parents, trusting the system, unknowingly became entangled in a speculative gamble, exacerbated by the euro's introduction and the franc's relative strength over time. It turns out that debt in a strong currency and income in a rapidly depreciating currency have only one outcome: Default over time.

As a result of the financial crisis of 2008, the Swiss National Bank could no longer suppress the upward pressure on the franc in 2014 and the fallout was inevitable. Overnight, my family faced a substantially larger loan burden than initially anticipated, to threaten us to file bankruptcy and lose everything we worked for in the previous decade. This devastating turn of events — driven by corrupt banking practices and greedy financial advisors — left an indelible mark on me. As a young man, witnessing my parents' hard-earned savings and efforts eroded by a system they trusted was enough to cement my distrust of financial institutions forever. At this point in time I made a promise to myself: Trust no one, educate yourself and verify.

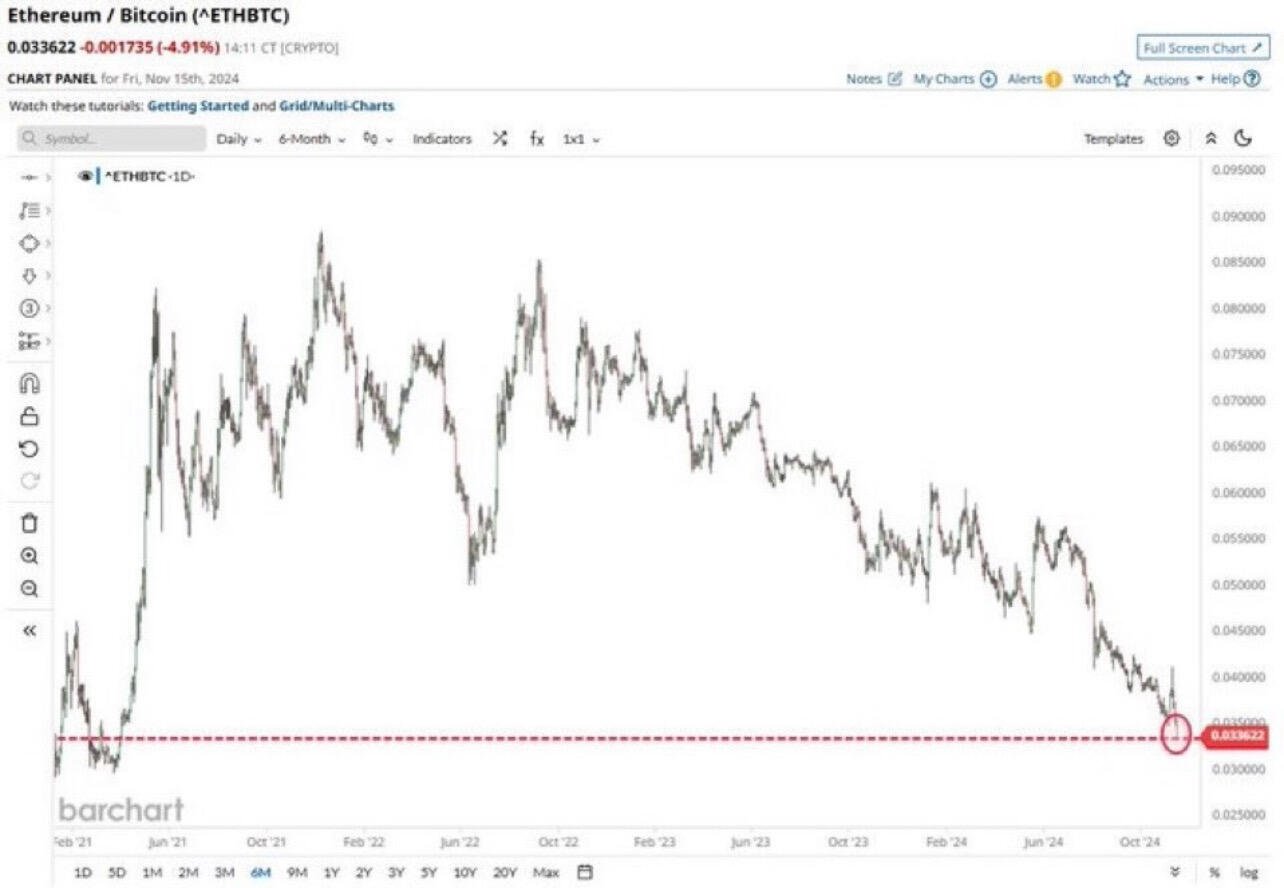

A few years later, I discovered Bitcoin. It clicked immediately. Here was a decentralized, incorruptible solution to the very problem that had caused so much pain for my family. Bitcoin represented a chance to opt out of a fiat system riddled with perverse incentives and predatory practices. My family's experience — our suffering under the weight of a corrupt financial system — motivates me to advocate for Bitcoin adoption. For this reason, I will never trade my Bitcoin for fiat currency ever, no matter the fiat price. It represents more than wealth to me; it’s a symbol of resilience and justice, a way to honor the sacrifices my parents made.

Looking back, I am almost grateful for this painful chapter of my life. It woke me up and set me on a path I might not have found otherwise. Many people experience similar losses at the hands of the fiat system without even realizing it because the theft happens incrementally, through inflation and hidden costs. Fact is, that honest, hardworking individuals are being robbed every day — second by second — by a system designed to erode their purchasing power over time. Like my parents, but more gradually.

While it’s exciting to see Bitcoin’s fiat price increase, that is not its ultimate value. Bitcoin represents so much more. And I know, many others who HODL Bitcoin not for fiat wealth but for deeply personal reasons — reasons rooted in justice, independence, and freedom. For those of us who have been wronged by the current system, Bitcoin is not just an asset, it’s a revolution for a better future.

Yours forever thankful, Carl. 🧡